Amazon Affiliate Tax Information India

In this post, I will show you how to fill amazon affiliate tax information or amazon associates tax interview as they call it, for Indian Affiliates. The steps are pretty much the same for other non-US affiliates as well.

It is essential to know that Amazon won’t pay you unless you have filled the tax information correctly. You must complete it as soon as you sign up for the Amazon Associates Program.

It is a bit of hassle to complete the tax interview, but this post has the complete procedure with step by step instructions and screenshots.

Make sure to follow it completely and start getting payments from Amazon US.

If you haven’t become an Amazon Affiliate yet, sign up using this link: Click Here

Step 1

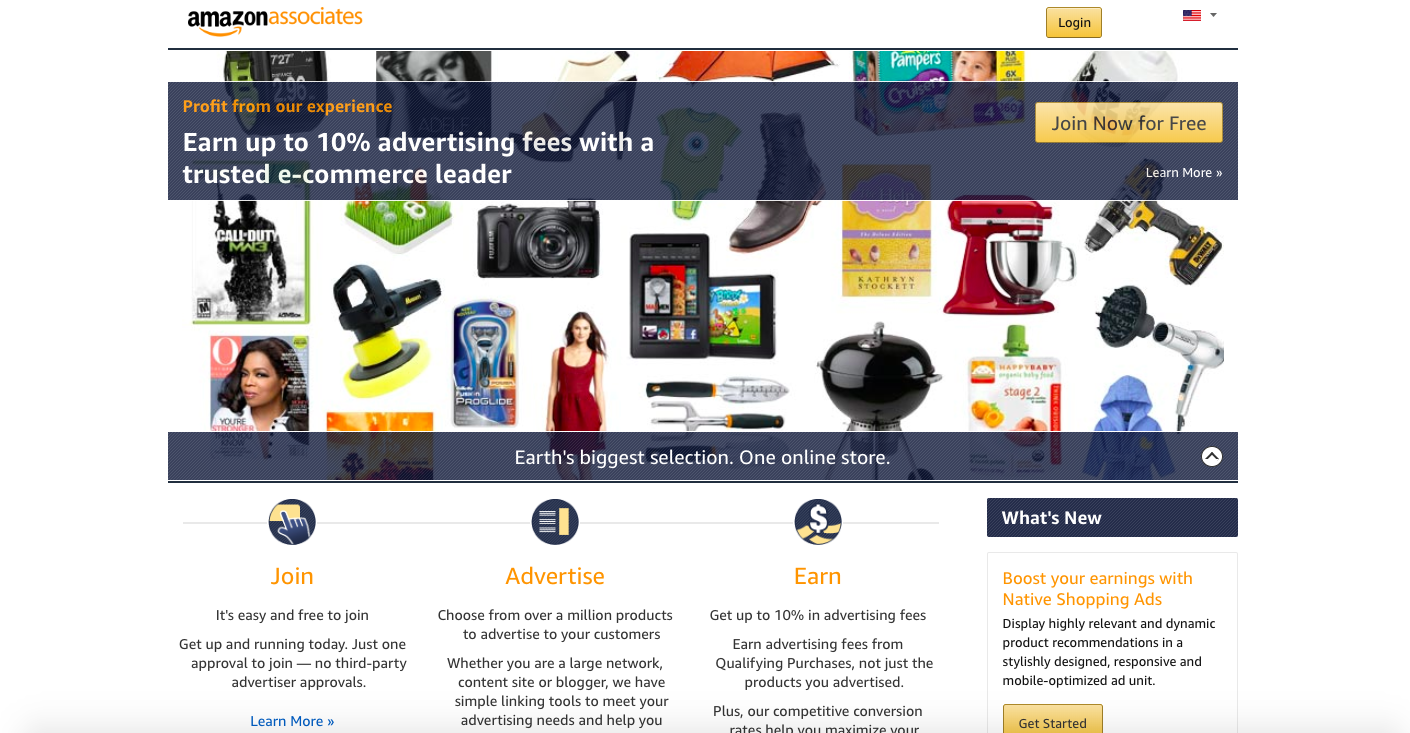

Log in to your Amazon Associates Account.

Step 2

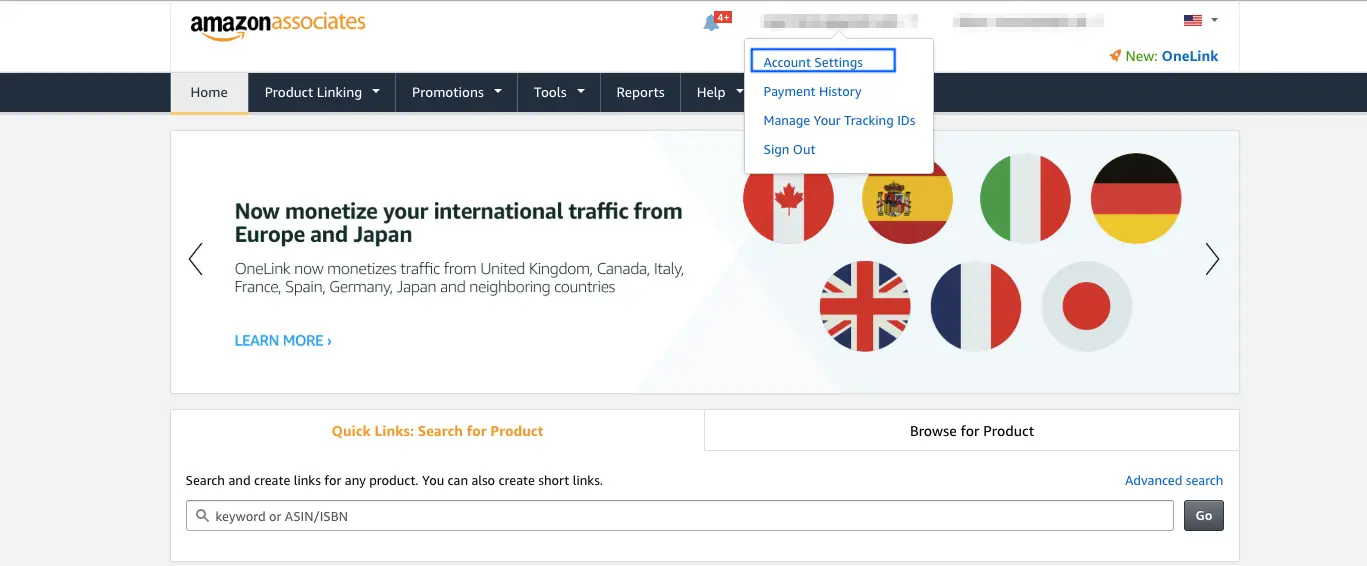

Hover over your email at the top of the page. Go to account settings.

Step 3

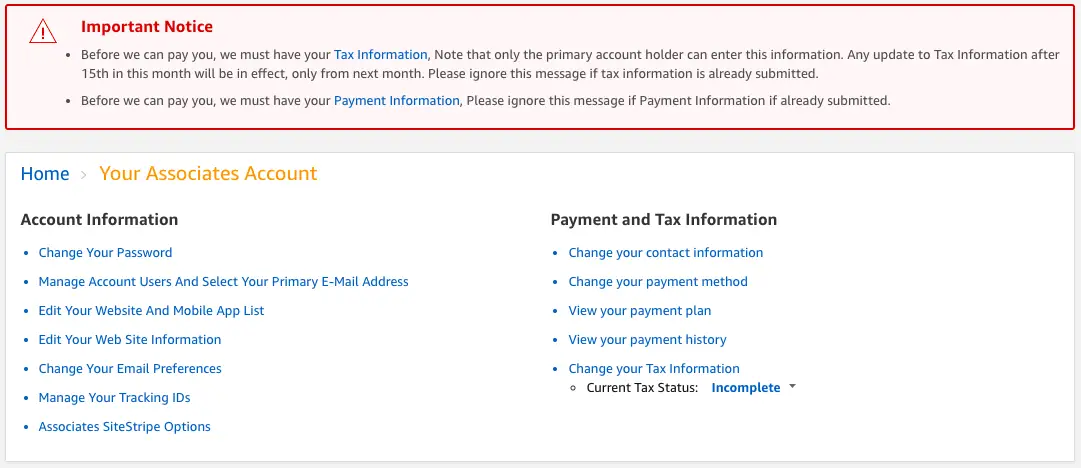

Under Payment and Tax Information, click on change your tax information.

Step 4

It will take you to take the Amazon Associates Tax Dashboard. Click on the button which says take interview.

Step 5

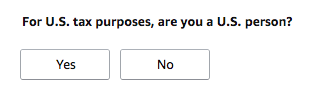

For U.S. tax purposes, are you a U.S. person?

If you are from India or you are not a US person, then select No.

Click on save and continue.

Step 6

Type of Beneficial Owner

Individual

Country Of Citizenship

India

Full Name

Enter your full name

Fill your Permanent Address.

For Mailing Address, select the same as Permanent Address.

Are you an agent acting as an intermediary?

No

Location of Services Performed

All services are performed outside the U.S.

U.S. person tests – individuals

Leave ALL Blank

Tax Identification Number (TIN)

I do not have a U.S. TIN or a foreign (non-U.S.) income tax identification number.

Click on Save and continue.

Step 7

The form will be shown to you. You can verify the details you have filled as of now. After doing that, click on Save and continue.

Step 8

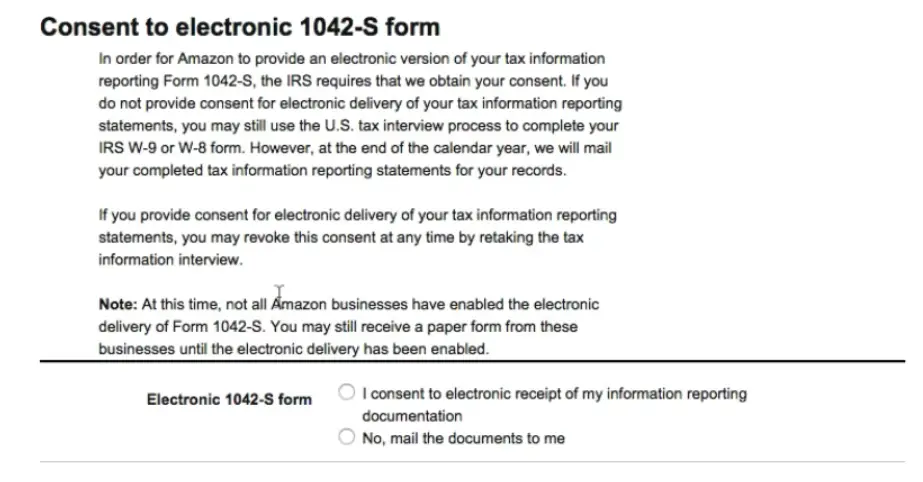

Consent to electronic delivery of Form 1042-S

Form 1042-S delivery preference

Choose Go paperless, I want to receive my form 1042-S electronically

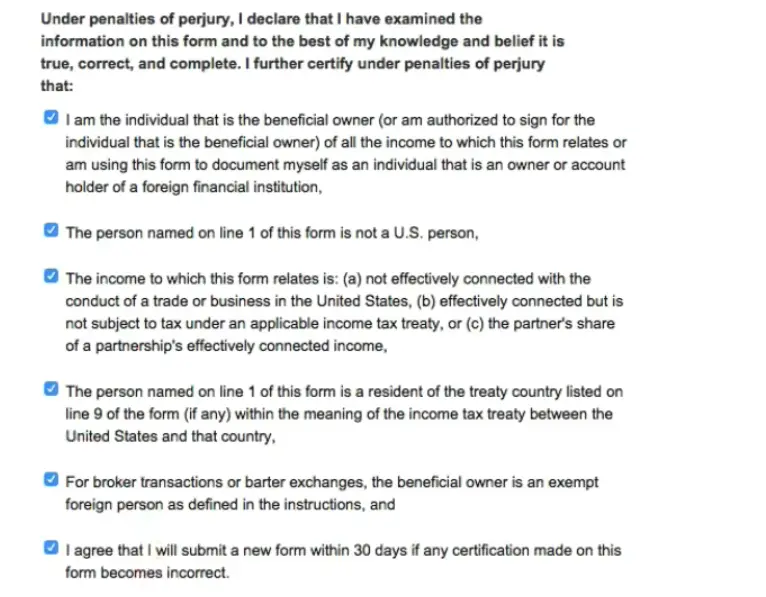

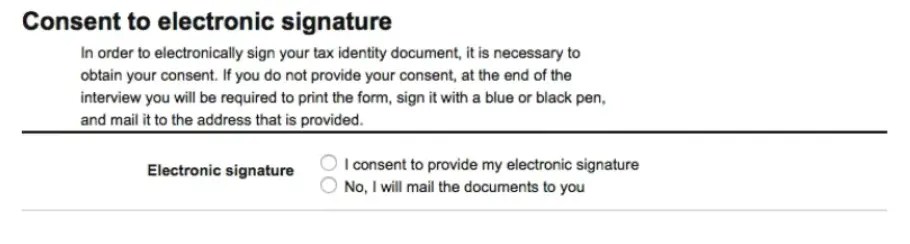

Consent to electronic signature

Choose I consent to provide my electronic signature. Tick all the options that you see.

Then enter your Name in the box asking for Signature of the beneficial owner.

The current date will be shown automatically.

In the box asking for the email address, enter your email.

For capacity, choose Individual.

Last Step

Click on submit to send your form to Amazon and then exit the tax interview.

Conclusion

I hope this guide helped you to fill the Amazon Associates Tax Information interview correctly for Indian Affiliates.

Now you need to fill your Payment Information, and then you will be eligible to receive payments from Amazon provided that you reach the minimum threshold (10$).

Do let us know if you face any problem in filling the amazon affiliate tax information for Non-US persons.

Best Fiverr Gigs 2022 – Make money with no skill and investment

Hello!!

thanks for your article

I have two question if maybe you can answer:

1/ After doing this, Amazon discount the taxes or we will have to pay later? How does it work in India and how much we have to pay?

2/There is any problem if the amazon account and the details are from a non-indian resident? So far i know it need to have a indian bank account ( so I do ) , but not being a resident

thanks

You can fill in your TIN and the tax withholding rate will be 0% for Non-US citizens. You just need to pay income tax on your income as per the country.

If I am a minor, should I register for the tax information or my gaurdian?

it tells me to put the tax information. when i click on the option it takes me to a blank page which never opens on Amazon. it shows if you continue to see this problem. contact the website owner. i am not able to receive my affiliate earnings due to this issue.

thankyou jiiii

Hello sir what should i do…caused the some amazon policy has been changed and form 1042- S form changed instead of 8233. So please tell me how can i fill it.

Great article

how does this work for a US citizen residing in the US ?

I am an x citizen of India and would probably have a PAN number from the past, but do not see a need to enter an address in india or the PAN number.

how do I skip this step and enter US tax information (SSN) for Amazon india !

TIA !!

Thank You Very Much!

God Bless You

Hi, how can i add payment info such as bank details, as there is option available to select location of bank as india. So how i can accept payment in my indian bank account is there platform to link it.

Hi Vinit, You can use your international bank details provided by Payoneer to receive the funds. Sign up here.

What happens if I can’t fill the tax information in associate amazon?